us germany tax treaty protocol

22 December 2021 The 2021 Protocol to the Germany-UK Double Taxation Convention. Double taxation is the levying of tax by two or more jurisdictions on the same income in the case of income taxes asset in the case of capital taxes or financial transaction in the case of sales taxes.

The Mfn Clause In Tax Treaties Is Jeopardising Tax Revenue For Lower Income Countries Ictd

This article is about certain views on the Kyoto Protocol to the United Nations Framework Convention on Climate Change.

. The MolotovRibbentrop Pact was a non-aggression pact between Nazi Germany and the Soviet Union that enabled those powers to partition Poland between them. برنامه جامع اقدام مشترک romanized. Preamble to US Model Income Tax Convention February 17 2016 US Model Income Tax Convention February 17 2016 Scroll down below the table of treaties and related documents to find the text of.

The Strategic Defense Initiative SDI derisively nicknamed the Star Wars program was a proposed missile defense system intended to protect the United States from attack by ballistic strategic nuclear weapons intercontinental ballistic missiles and submarine-launched ballistic missilesThe concept was announced on March 23 1983 by President Ronald Reagan a vocal. New Zealand has a network of 40 DTAs in force with its main trading and investment partners. It covers all key areas including transparency finance mitigation and adaptation and provides flexibility to Parties that need it in light of their capacities while enabling them to.

The text of the current US Model Income Tax Convention and accompanying preamble are available here. International law also known as public international law and the law of nations is the set of rules norms and standards generally recognized as binding between states. The convention replaces the tax convention that was signed with the Federal Republic of Germany on July 22 1954 and amended by the protocol of September 17 1965.

Stimulus and stabilization efforts initiated in 2008 and 2009 and tax cuts introduced in Chancellor Angela MERKELs second term increased Germanys total budget deficit - including federal state and municipal - to 41 in 2010 but slower spending and higher tax revenues reduced the deficit to 08 in 2011 and in 2017 Germany reached a budget. Exempt foreign-source income from tax exempt foreign-source income from tax if tax had. Protocol PDF - 2006.

In May 2016 the Institute for Fiscal Studies said that an EU exit could mean two more years of austerity cuts as the government would have to make up for an estimated loss of 20 billion to 40 billion of tax revenue. This is due to newswire licensing terms. The complete texts of the following tax treaty documents are available in Adobe PDF format.

HM Treasury is the governments economic and finance ministry maintaining control over public spending setting the direction of the UKs economic policy and working to achieve strong and. It is based on model income tax treaties developed by the Department of the Treasury and the Organization for Economic Cooperation and Development. J15407 to one US dollar November 1 2022 KINGSTON Jamaica The US dollar on Tuesday November 1 ended.

The national interest analysis is published as part of the Select Committee report back to the House and links to these reports are included on each countrys tax treaty web page. Get the latest international news and world events from Asia Europe the Middle East and more. Negotiators have concluded bilateral agreements with 28 important trading partners to coordinate social security coverage and benefit provisions for individuals who live and work in more than one country in their working lives.

Since the 1970s US. It establishes normative guidelines and a common conceptual framework for states across a broad range of domains including war diplomacy economic relations and human rights. The article you have been looking for has expired and is not longer available on our system.

The texts of most US income tax treaties in force are available here. The latest news and headlines from Yahoo. Double liability may be mitigated in a number of ways for example a jurisdiction may.

DTAs reduce tax impediments to cross-border trade. The Joint Comprehensive Plan of Action JCPOA. 1 Australias income tax treaties are given the force of law by the International Tax Agreements Act 1953The Agreement between the Australian Commerce and Industry Office and the Taipei Economic and Cultural Office concerning the Avoidance of Double Taxation and the Prevention of Fiscal Evasion with respect to Taxes on Income is a document of less than treaty status.

The head of the IFS Paul Johnson said that the UK could perfectly reasonably decide that we are willing to pay a bit of a. See Table 3 of the Tax Treaty Tables for the general effective date of each treaty and protocol. If you have problems opening the pdf document or viewing pages download the latest version of Adobe Acrobat Reader.

It was signed by 154 states at the United Nations Conference on Environment and Development UNCED. Barnāmeye jāmee eqdāme moshtarak برجام BARJAM known commonly as the Iran nuclear deal or Iran deal is an agreement on the Iranian nuclear program reached in Vienna on 14 July 2015 between Iran and the P51 the five permanent members of the United Nations Security. On May 25 2017 22 Republican Senators including Senate Majority Leader Mitch McConnell sent a two-page letter to Trump urging him to withdraw the.

The Protocol signed at Berlin on June 1 2006 amended Article 26 of the Tax Treaty between the United States of America and the Federal Republic of Germany for the Avoidance of Double Taxation and the Prevention of Fiscal Evasion with Respect to Taxes. The Katowice package adopted at the UN climate conference COP24 in December 2018 contains common and detailed rules procedures and guidelines that operationalise the Paris Agreement. Get breaking news stories and in-depth coverage with videos and photos.

This page provides links to tax treaties between the United States and particular countries. Jcan business interests encouraged to apply for US E2 Treaty Investor Visa. For further information on tax treaties refer also to the Treasury Departments Tax Treaty Documents page.

A 2007 study by Gupta et al. Assessed the literature on climate change policy which showed no authoritative assessments of the UNFCCC or its Protocol that assert these agreements have or will succeed in fully solving the climate problem. Germany - Tax Treaty Documents More In File.

The document 2010 Germany-UK Double Taxation Convention as amended by the 2021 Protocol - in force has been added. Known as totalization agreements they are similar in function and structure to treaties and are legally. In April 2017 a group of 20 members of the European Parliament from the right-wing Alternative for Germany UK Independence Party and other parties sent a letter to Trump on urging him to withdraw from the Paris Agreement.

The pact was signed in Moscow on 23 August 1939 by German Foreign Minister Joachim von Ribbentrop and Soviet Foreign Minister Vyacheslav Molotov and was officially known as the Treaty of Non. The United Nations Framework Convention on Climate Change UNFCCC established an international environmental treaty to combat dangerous human interference with the climate system in part by stabilizing greenhouse gas concentrations in the atmosphere.

Germany Uk Double Taxation Treaty Atoz Serwis Plus Germany

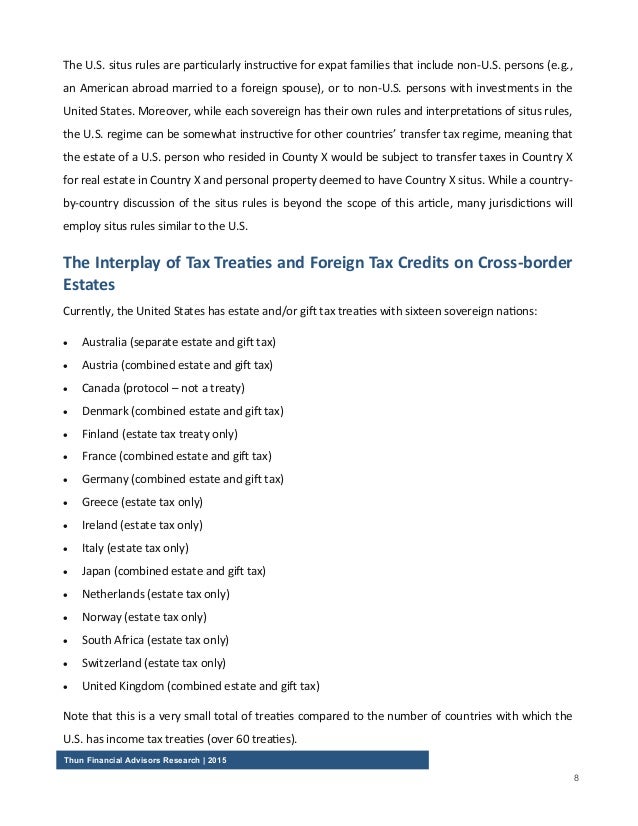

A Deep Dive Into U S Estate And Gift Tax Treaties Sf Tax Counsel

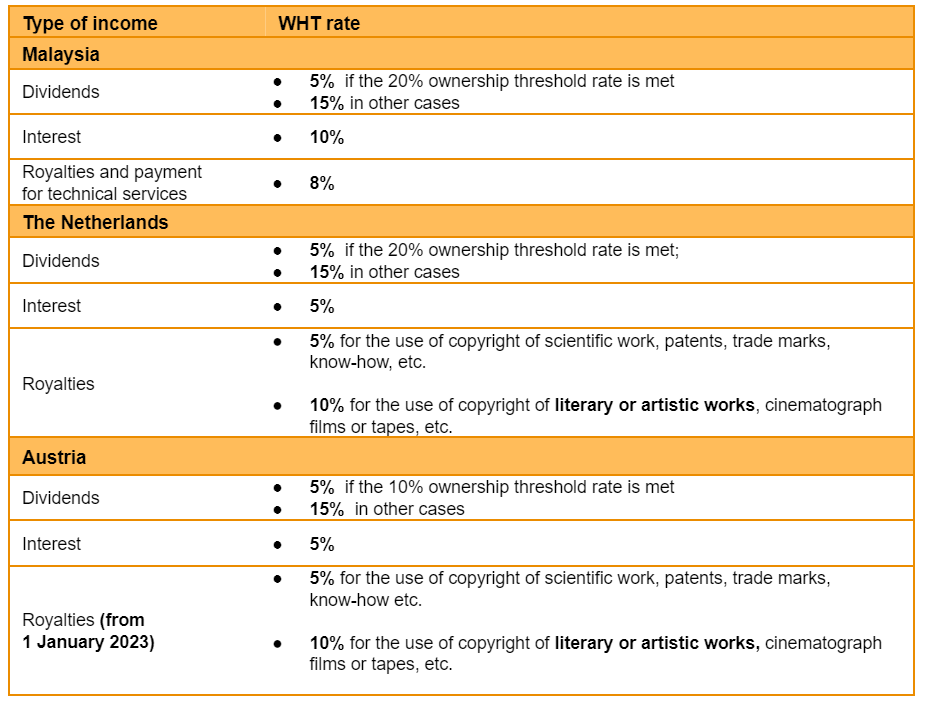

International Tax News And Other Global Updates For Q2 2022 Our Insights Plante Moran

Practical Us International Tax Strategies Chadbourne Amp Parke Llp

2007 Ofii Tax Conferenceaventura Fl 1 U S Tax Developments Inbound Investment Into The U S Technical Updates Planning Strategies Presented By James Ppt Download

Department Of Taxation And Finance Hi Res Stock Photography And Images Alamy

Germany Specific Tfx User Guide

Multilateral Convention To Implement Tax Treaty Related Measures To Prevent Base Erosion And Profit Shifting Wikipedia

Germany Specific Tfx User Guide

Cyprus And Germany Sign Protocol To Amend Tax Treaty International Tax Review

Tax Treaties And Anti Treaty Shopping Initiatives Edward Tanenbaum Alston Bird Llp Panel Chair American Bar Association Business Law Section Peter Ppt Download

International Estate Planning For Cross Border Families

Cyprus And Germany Sign Protocol To Amend Tax Treaty International Tax Review

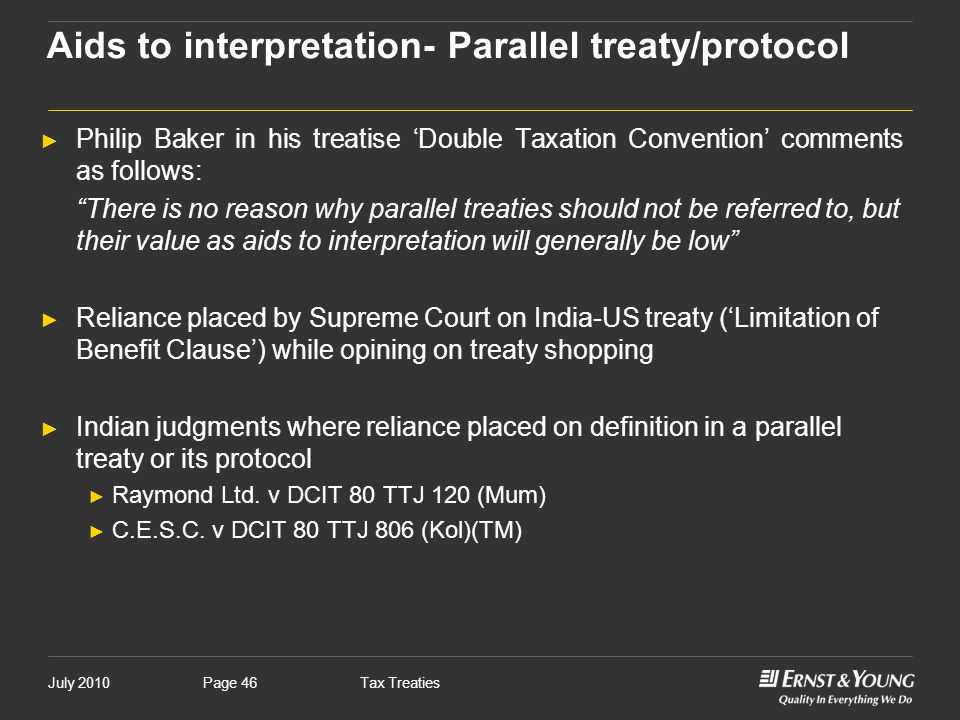

Tax Treaties International Scenario And India Relevance Amarpal S Ppt Download

Reflections On The Recently Signed Amendment Protocol To The Dutch German Tax Treaty Insights Dla Piper Global Law Firm